Wealth – the goose or the egg?

Adam Smith, described wealth as “the annual produce of the land and labour of the society”. Implicitly, in this definition a profit & loss approach is utilized, being a measure of income per year, as opposed to a balance sheet approach, with total accumulated non-consumed production.

This profit & loss approach has become commonplace. Frequently economists define wealth as GDP per capita: the average amount of goods an services which are produced per person in a year. However, this GDP per capita gives an indication of the average consumption level only on a short time frame. “Gauging an economy by its GDP is like judging a company by its quarterly profits, without looking at its balance-sheet”, as the Economist asserted. The link between the two approaches shows up via the concept of net present value and there is a marked cross-country correlation between total accumulated wealth and GDP.

Instead of looking at the value of production, it is probably more useful to look at the total accumulated value of production capacity. Following the United Nations work of Partha Dasgupta the concept of inclusive wealth could be used as a gauge of this production capacity. Dasgupta defines inclusive wealth as the sum of i) human capital, ii) manufactured capital and iii) natural capital. Social capital is not separately considered but is supposed to serve as an underlying and fundamental driver for human and manufactured capital.

So, what is wealth? Production or production capacity? Probably, production capacity gauges wealth in a more complete way, but it is even harder to measure than GDP per capita and also has no long historical track-record. Fortunately, the relation between inclusive wealth and GDP per capita suggests that GDP per capita is a reasonable proxy for wealth. Therefore we will use this measure for further long term analysis.

References:

- http://www.economist.com/blogs/graphicdetail/2012/06/daily-chart-10

Ideas:

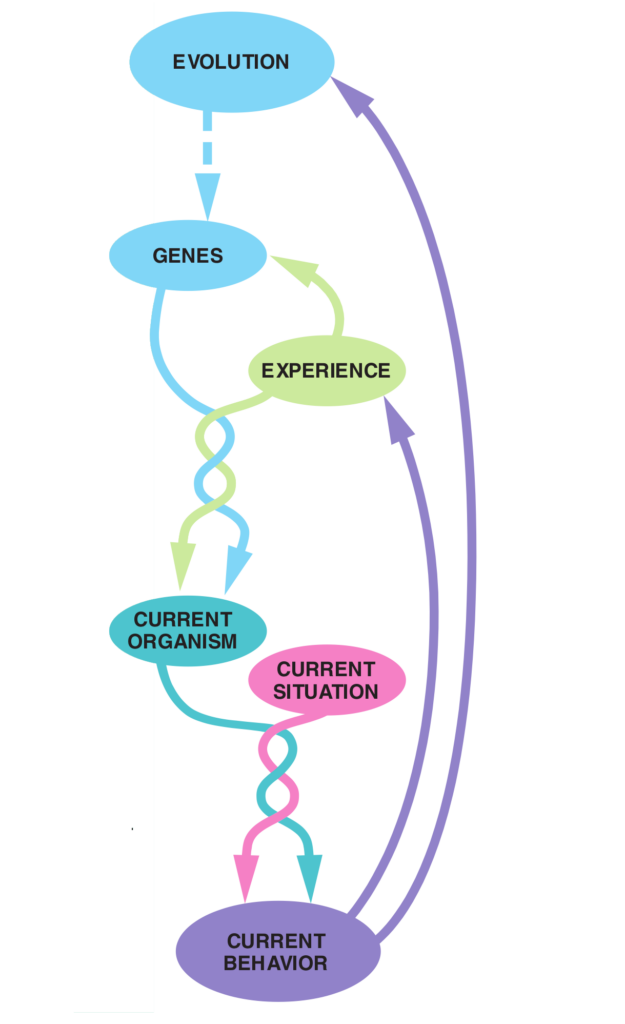

- Wealth is the ability to utilize production facilities of resources which are fitness enhancing. Link with evolution.

- There is a correlation between the concept of capital and income and nature versus nurture: evolution has given people the mental and physical hardware (behavioral capital), whereas the actual fruits (behavioral income) of that capital differ from person to person and circumstances. Example: people cannot talk at birth, but are born with the capacity to learn a language.